A Quota Is A Tax Placed On Imports

An excess of exports over imports a tax placed on imports. An excess of exports over imports.

Quota A Limit On Either The Quantity Or Monetary Value Of A Product That May Be Imported Vocab Chapter Pie Chart

Whereas a tariff refers to the tax imposed on the imports coming into a country.

A quota is a tax placed on imports. Psychological economics o c. Governments impose both quotas and tariffs as protective measures to try to control trade. A tax on an imported good is called a a.

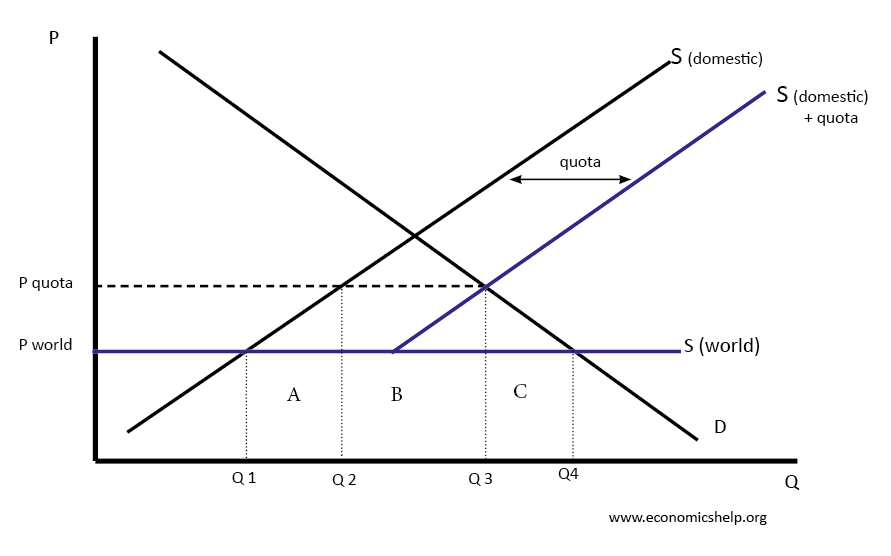

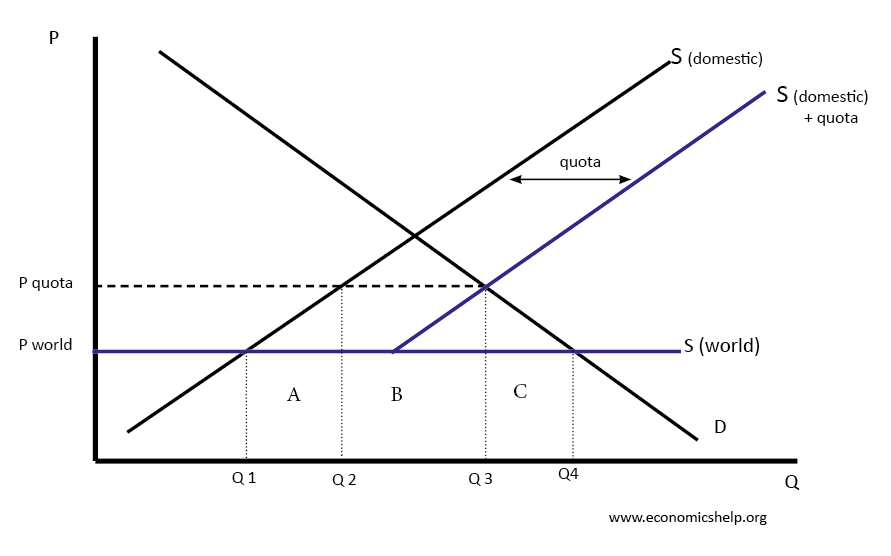

An import quota is a type of trade restriction that sets a physical limit on the quantity of a good that can be imported into a country in a given period of time. Question 4 a quota is o a. This sort of barrier is often associated with the issuance of licenses.

A tax levied on exports whereas a quota is a limit on the number of units of a good that can be exported. A country has a comparative advantage in a product if the world price is. A tax placed on imports.

Agricultural tariff rate quotas. Trqs related to agricultural products are currently managed through two different methods. A tax imposed on imports whereas a quota is an absolute limit to the number of units of a good that can be imported.

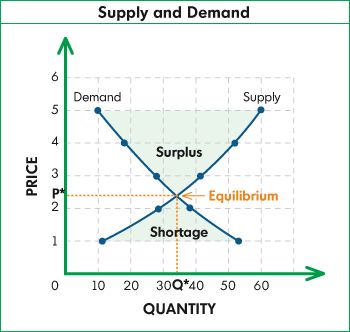

Tariffs and quotas can be used for many reasons. With no trade equilibrium market price in the country will exist at. Aim of tariff rate quotas.

Quotas like other trade restrictions are typically used to benefit the producers of a good in that economy. Quota is the limit drawn on how much of a particular product can be imported by a country. Import quotas are a form of restriction imposed by the government on trade of a particular commodity by imposing restriction on either fixed in terms of value or quantity of the product which can be imported during a given period of time usually for one year usually been imposed by the government to provide benefits to local producers.

Tariffs which are taxes or duties on imported goods designed to raise the price to the level of or above the existing domestic price and non tariff barriers which include all other barriers such as. A tax on exports to other countries. There are two types of protection.

Behavioral economics o b. A tax on exports to other countries o d. A tariff differs from a quota in that a tariff is.

Given below are some reasons highlighting the importance of tariffs and quotas. A quota is a. A limit on the quantity of imports.

Tariff rate quotas trqs allow a pre determined quantity of a product to be imported at lower import duty rates in quota duty than the duty rate normally available for that product. Quotas are different from tariffs or customs which place taxes on imports or exports. A limit on the quantity of imports question 5 economists use basic psychological insights in the field of studv called o a.

A quota is a limit to the quantity coming into a country. Levied on exports whereas a quota is imposed on imports. An import quota is a restriction placed on the amount of a particular good that can be imported.

This sort of barrier is.

No Prep Economics Word Search Puzzle Economics For Kids School Worksheets Worksheets For Kids

No Prep Economics Word Search Puzzle Economics For Kids School Worksheets Worksheets For Kids

Top 10 Ap Macroeconomics Exam Concepts To Know Macroeconomics Economics Lessons Micro Economics

Top 10 Ap Macroeconomics Exam Concepts To Know Macroeconomics Economics Lessons Micro Economics

27 Economic Objectives Of The Gov 1 Managerial Economics Economics Lessons Economics Notes

27 Economic Objectives Of The Gov 1 Managerial Economics Economics Lessons Economics Notes

If You Do Not Know How To Find Hs Codes For Products Then It Would Be A Nice Idea To Visit The Seair Exim Solutions Site For Hel Coding Online Coding Search

If You Do Not Know How To Find Hs Codes For Products Then It Would Be A Nice Idea To Visit The Seair Exim Solutions Site For Hel Coding Online Coding Search

Protectionism Defending The Domestics Domestic Economics Defender

Protectionism Defending The Domestics Domestic Economics Defender

Non Tariff Barriers Black Glyph Icon In 2020 Glyph Icon Glyphs Photoshop Design

Non Tariff Barriers Black Glyph Icon In 2020 Glyph Icon Glyphs Photoshop Design

32 Evolution Of The International Eco Sys Teaching Economics Economics Lessons Economics 101

32 Evolution Of The International Eco Sys Teaching Economics Economics Lessons Economics 101

An Illustrated Tutorial On The Economic Benefits Of International Trade Including How A Country Profits From Exp With Images International Trade Economics Lessons Benefit

An Illustrated Tutorial On The Economic Benefits Of International Trade Including How A Country Profits From Exp With Images International Trade Economics Lessons Benefit

Supply And Demand Poster Project

Supply And Demand Poster Project

Supply And Demand Economics Lessons Economics Economics Notes

Supply And Demand Economics Lessons Economics Economics Notes

Economics Of The Sugar Tax Economics Lessons Teaching Economics Economics Notes

Economics Of The Sugar Tax Economics Lessons Teaching Economics Economics Notes

Image Result For Indirect Tax With Deadweight Loss Indirect Tax Loss Tax

Image Result For Indirect Tax With Deadweight Loss Indirect Tax Loss Tax

Image Result For Import Quota Diagram

Image Result For Import Quota Diagram

Tax Concept Deadweight Loss Tax In Perfect Competition And Monopoly Economics Lessons Economics Notes Perfect Competition

Tax Concept Deadweight Loss Tax In Perfect Competition And Monopoly Economics Lessons Economics Notes Perfect Competition

Why Waste Your Time With Fake Account Managers And Irrelevant Brokers When You C Forex Teaching Economics Economics Lessons Microeconomics Study

Why Waste Your Time With Fake Account Managers And Irrelevant Brokers When You C Forex Teaching Economics Economics Lessons Microeconomics Study

Slide 10 Jpg 960 720 Good Grades Macroeconomics Economics 101

Slide 10 Jpg 960 720 Good Grades Macroeconomics Economics 101

Economics Of The Sugar Tax Economics Lessons Teaching Economics Economics Notes

Economics Of The Sugar Tax Economics Lessons Teaching Economics Economics Notes

Change Copy Based On Their Country S Talking Style English Gentleman Addressing Copywriting

Change Copy Based On Their Country S Talking Style English Gentleman Addressing Copywriting

Pin By Lili On Vsco Economics Vocabulary Parliamentary Democracy Member Of Parliament

Pin By Lili On Vsco Economics Vocabulary Parliamentary Democracy Member Of Parliament